Category: Tokenization

-

How Moctezuma Is Revolutionizing Real Estate Tokenization for Financial Institutions

Moctezuma is revolutionizing real estate by enabling financial institutions to tokenize property, reducing purchase times from months to just **one day**. Leveraging blockchain technology and compliant with **MiCA** and **CySEC** regulations, Moctezuma transforms property documents into secure, digital tokens. This white-label platform integrates seamlessly with existing systems, offering **flat fees** instead of percentage-based costs. Banks… Read more

-

I Bought My First On-Chain AI Agent: Meet Misato

Imagine interacting with an AI agent that not only engages with you personally and professionally but also allows you to invest in its tokenized future. Read more

-

How Tokenizing AI Agents Could Revolutionize Work and Investment

Imagine owning a digital employee—an AI agent—that not only works tirelessly for you but also generates revenue autonomously. Read more

-

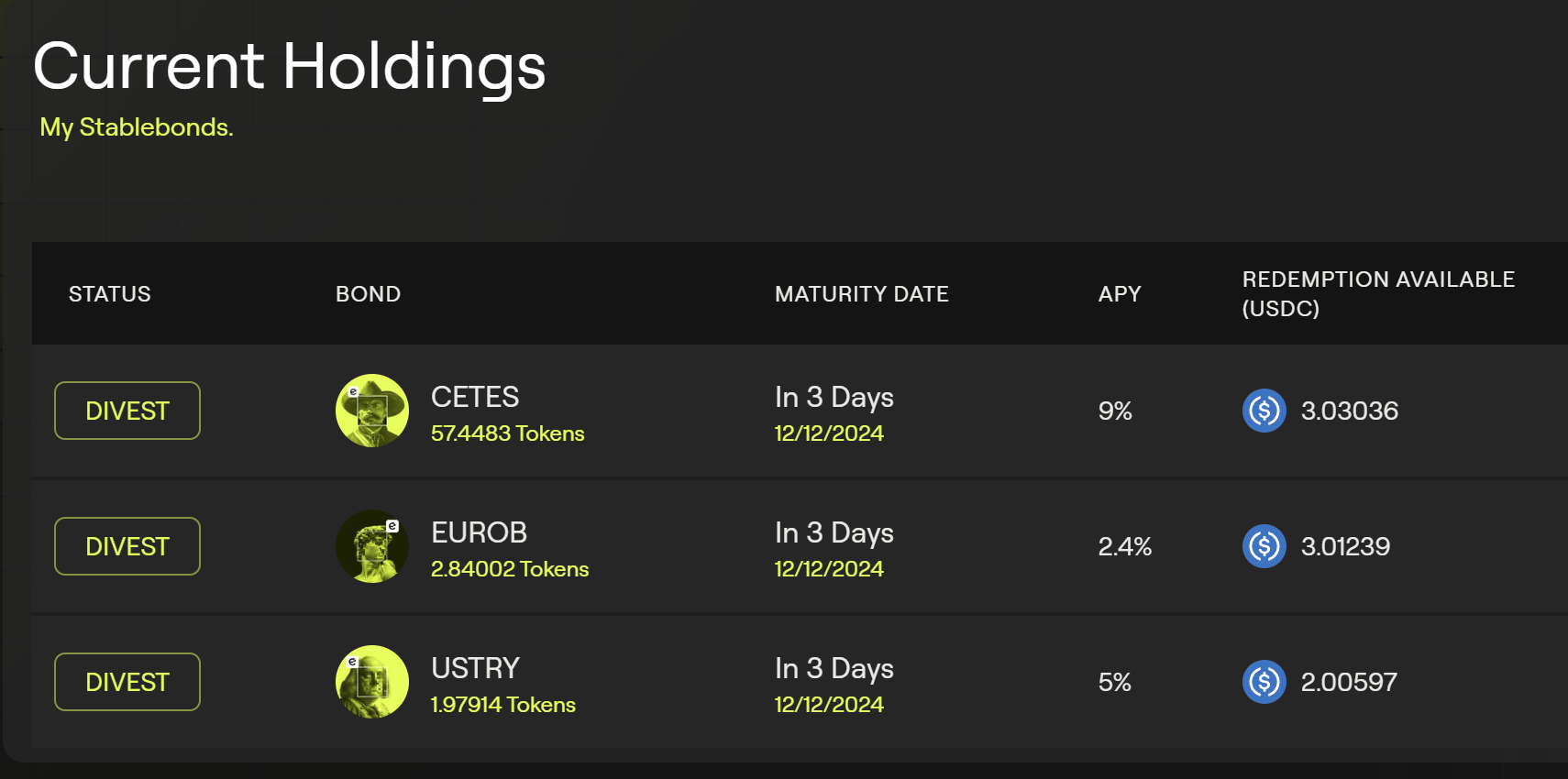

How to Buy Government Bonds Worldwide Using Blockchain Technology

With just $10, I built a diverse bond portfolio spanning four countries—US, Mexico, the UK, and the EU. This is the power of blockchain-enabled tokenization. It’s fast, affordable, and opens doors to global investment opportunities. Read more

-

Types of assets

Let’s break it down. What types of assets are out there, how are they different, and why does it even matter? From financial assets, to physical assets to crypto. Read more

-

Is Stablebond the Future of bonds?

Stablebond are blockchain-based tokens that represent ownership of government issued bonds, created by the Mexican company EtherFuse. These tokens simplify access to government-backed securities, offering a seamless and affordable way for users to invest. The process begins with the user setting up a blockchain-based wallet. Bonds are essentially loans supported by governments, providing a secure… Read more