When I look at the evolving crypto infrastructure, it’s hard not to marvel at the speed of change and the powerful trends shaping our digital financial world. Let me break down the key takeaways from my analysis of these shifts, particularly from Andrei Horowitz’s 2024 report on the state of crypto.

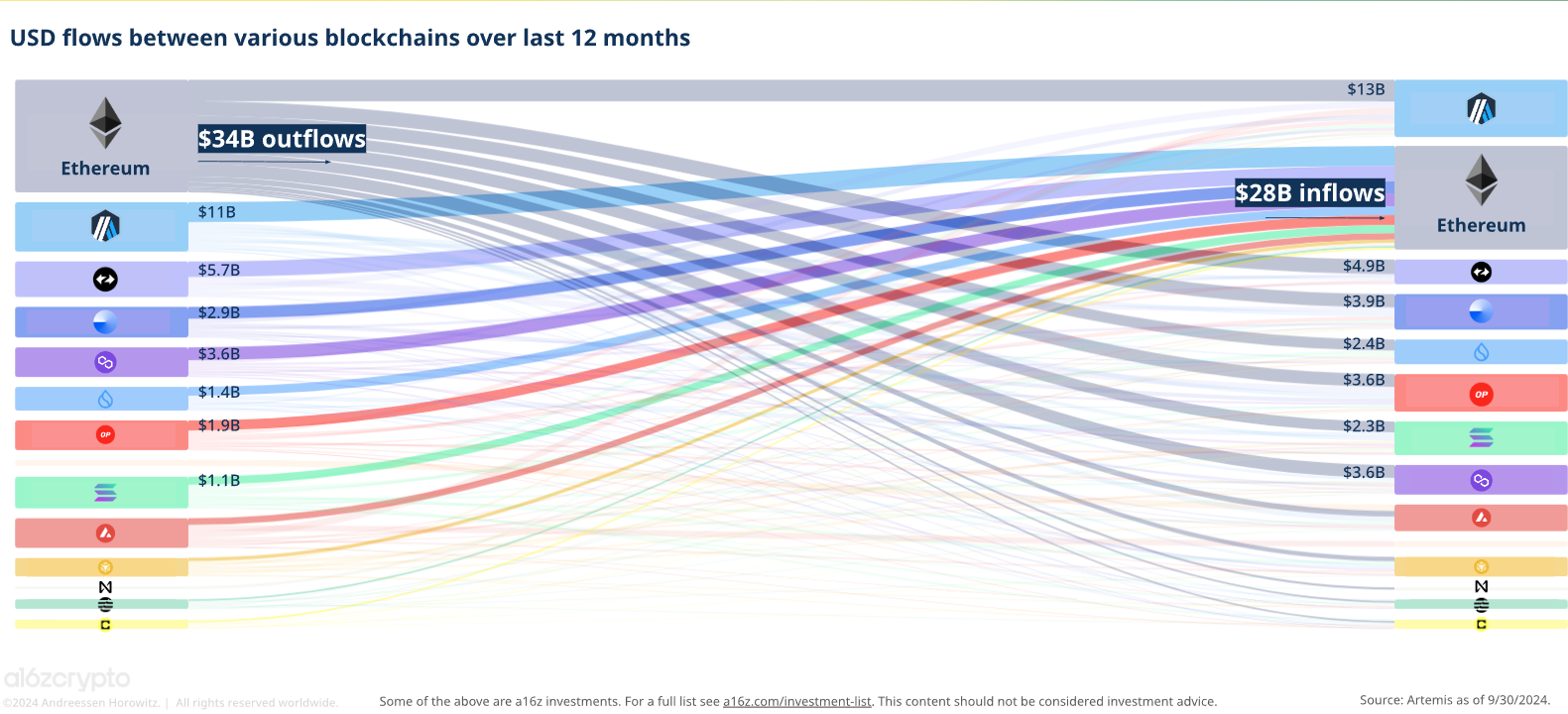

First, let’s talk money flow across blockchains—one of the most fascinating aspects. Ethereum still dominates in terms of the sheer volume of USD flowing across chains, but outflows are now diverting to some interesting destinations. Take Arbitrum, Optimism, and others; they’re attracting significant portions of Ethereum’s outgoing flows. It’s intriguing because Ethereum essentially serves as the conduit, transferring a staggering $34 billion, of which only $2.3 billion actually ends up on Solana. Solana’s own outflows primarily route back to Ethereum, underscoring the Ethereum ecosystem’s influence and its appeal as a liquidity hub—even with Solana leading in active addresses.

Now, why does Ethereum still reign supreme, even as Solana leads in user count? Ethereum’s layer-2 solutions like Optimism, Base, and Polygon are a big reason. The cost to transact on these layer-2 networks is remarkably low—down to just a few cents. I remember a time when Ethereum transactions could easily cost $20, which stunted adoption. But today, for example, Base from Coinbase processes transactions for as low as one cent. It’s a game-changer for everyday users and opens up a whole new era of usability. Solana is right there too in terms of low transaction costs, essentially functioning as an affordable layer-1 competitor to Ethereum’s layer-2s.

Then, there’s a fascinating trend in which “superchains” are emerging. Ethereum and Solana may be major players, but new contenders are gaining traction, especially through enhanced smart contract functions. For example, Base is becoming a leader in daily active addresses due to its versatility, supporting everything from multi-factor authentication to complex spending limits and bundling.

Moving from infrastructure to applications, we see clear use cases leading the way. Decentralized finance (DeFi) still tops the list, channeling the ethos of Satoshi’s original vision for peer-to-peer financial systems. Right behind is stablecoin usage, which has taken off, allowing people worldwide to transact in digital dollars. Currently, PayPal still boasts six times more transactions than stablecoins, but it won’t stay that way for long. As stablecoins grow, especially in high-inflation economies, this gap will shrink rapidly.

On the broader frontier, we’re in the midst of a conversation around decentralized AI. Right now, the AI landscape is dominated by centralized giants like OpenAI alumni and the so-called “Magnificent Seven” tech titans (think NVIDIA, Microsoft, and the rest). Decentralization might seem far-fetched, but there’s a movement to harness individual machines’ power to compete in AI development. Imagine a world where regular users contribute their computing power, similar to a GPU, to run decentralized AI models. It’s ambitious but fascinating—and a major departure from today’s centralized AI ecosystems.

We can’t talk crypto without touching on the NFT market and, of course, meme coins. The NFT space has evolved beyond the hype of its 2021-22 peak into what I’d call “social collecting experiences.” And meme coins? We’re in a “meme coin supercycle,” driven by platforms like Tom.Fun, where I’m diving deeper to understand how 10,000 meme coins can launch daily, thanks to Solana’s low costs and blazing transaction speeds.

However, all this growth brings challenges. Cybersecurity remains a significant vulnerability in the space, with companies often under-investing in robust security frameworks. Crypto hacks are far too common, and there’s still a huge gap in effective, enterprise-level security investments across these projects.

The report ends on an exciting note with DePIN (decentralized physical infrastructure networks), which include promising sectors like gaming and social networks built on Web3 tech, like Farcaster and Lens Protocol. We may not have seen the next big crypto gaming cycle just yet, but the seeds are undoubtedly being sown.

Thanks for joining me on this journey through the infrastructure landscape of crypto in 2024. There’s so much unfolding every day, from Ethereum’s layer-2 solutions to Solana’s rapid adoption and the rise of stablecoins and DePIN.

13 responses to “Ethereum vs Solana according to a16z report”

how to order androxal purchase online from india

order androxal usa overnight delivery

order enclomiphene cheap with prescription

cheap enclomiphene next day delivery

cheap rifaximin canada how to buy

how to buy rifaximin generic from canada

discount xifaxan generic compare

discount xifaxan cheap in canada

purchase staxyn australia price

buying staxyn price south africa

get avodart buy for cheap

how to order avodart cheap melbourne

how to buy dutasteride united kingdom

buy cheap dutasteride usa pharmacy

cheap flexeril cyclobenzaprine buy safely online

how to buy flexeril cyclobenzaprine usa seller

generic gabapentin in pharmacy

ordering gabapentin generic gabapentins

mohu získat kamagra v obchodě wal-mart bez preskripce

kamagra generický 100 mg v propagační ceně nebo bezplatné nabídce

acheter kamagra en ligne pas cher

kamagra coupons de réduction

generic fildena online canada

buying fildena cheap canada pharmacy

buy cheap itraconazole generic in usa

how to buy itraconazole cheap pharmacy