Introduction

Imagine earning money by lending it to the government—sounds like a dream, right? Well, that’s exactly how government bonds work! For centuries, nations have raised funds through bonds, and now, thanks to blockchain technology, you can invest in these bonds from anywhere, using just your computer.

In this article, we’ll walk through how to buy US, Mexican, British, and European government bonds using blockchain. It’s a quick, seamless process that eliminates traditional barriers. Plus, you can sell these bonds whenever you need the funds.

Let’s dive into the process step by step.

Step 1: Setting Up Your Wallet

Before purchasing bonds, you need a crypto wallet. I recommend Phantom Wallet because it’s user-friendly and works seamlessly with the Solana blockchain.

- Download and connect your wallet.

- Ensure you have some USDC (a stablecoin pegged to the US dollar) and a small amount of Solana (SOL) for transaction fees.

Step 2: Buying a Bond

Let’s start by purchasing a Mexican government bond. Here’s how:

- Select the bond on the platform (in this example, Etherfuse).

- Input the amount you want to invest. For instance, I purchased $3 worth of USDC.

- Click Purchase, and confirm the transaction in your wallet.

- Read and accept the legal agreement provided by the issuer.

- Verify your identity (KYC process).

- Once verified, confirm the transaction.

Boom! I just bought a Mexican government bond offering a 9% annual yield (APY), denominated in Mexican pesos.

Step 3: Expanding Your Portfolio

Repeat the same process for bonds in other regions:

- European Bonds: Offering a 2.4% APY in euros.

- British Bonds: With a 3% APY, denominated in British pounds.

- US Bonds: Yielding 5% APY, denominated in US dollars.

The blockchain (via Solana and Stellar networks) ensures the transaction is transparent and secure.

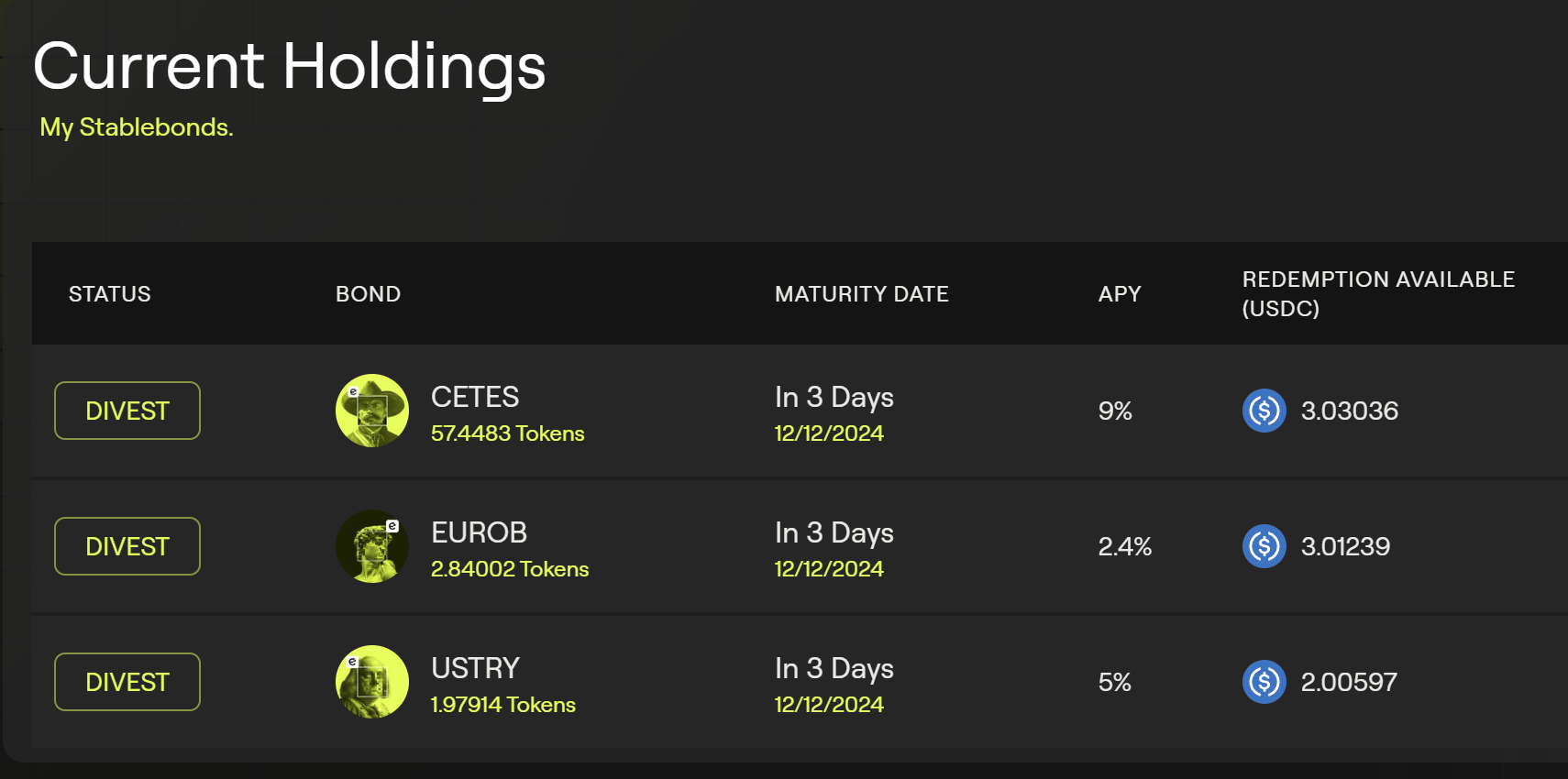

Step 4: Tracking Your Holdings

After purchasing, you can track your portfolio directly in your wallet:

- View your holdings by clicking on the “Account” section.

- Each bond is tokenized and represented as a digital asset.

- You’ll also see details like bond maturity dates and current values.

Selling Your Bonds

What if you need cash before the bond matures? No problem.

- Go to your account and select the bond you want to sell.

- Choose how much you’d like to divest (e.g., 25%, 50%, or 100%).

- Select your selling option:

- Immediate Divestment: Sell right away (fees apply).

- End of Issuance: Wait until the bond matures for lower fees.

- Confirm the transaction in your wallet.

For example, I sold a portion of my British bond and instantly received $2 back into my wallet.

Why Blockchain Makes This Better

Traditional bond purchases are cumbersome, involving banks, brokers, and high fees. With blockchain:

- Accessibility: Invest as little as $10 in bonds from multiple countries.

- Speed: Transactions complete in seconds.

- Transparency: Verify every transaction on the Solana blockchain.

- Flexibility: Buy and sell bonds anytime, without intermediaries.

Conclusion

With just $10, I built a diverse bond portfolio spanning four countries—US, Mexico, the UK, and the EU. This is the power of blockchain-enabled tokenization. It’s fast, affordable, and opens doors to global investment opportunities.

What do you think about this revolutionary approach to bond investment? Let me know in the comments!

12 responses to “How to Buy Government Bonds Worldwide Using Blockchain Technology”

buy cheap enclomiphene purchase discount

cheapest buy enclomiphene generic real

medicament kamagra en ligne afin

comprar kamagra en arg

buy androxal price singapore

buy cheap androxal cost effectiveness

how to buy flexeril cyclobenzaprine australia discount

how to buy flexeril cyclobenzaprine low cost

ordering gabapentin australia purchase

purchase gabapentin united kingdom

online order fildena generic does it work

purchase fildena price canada

order itraconazole cost usa

am a womani have emphysema low hemo etc dr wants to prescribe itraconazole

purchase avodart buy for cheap

cheap avodart australia price

buy cheap staxyn generic version

staxyn no prescription canadian

cheapest buy rifaximin generic uk next day delivery

purchase rifaximin australia to buy

buying xifaxan uk meds

how to order xifaxan uk buy over counter

kamagra žádné rx krmení ex

obecný kamagra ve spojených státech